Final

Exam

(You

may omit any complete question or questions for 20% credit)

I. Your

client was injured by a drunk driver; the other party's attorney has conceded

liability but disagrees with you about the amount of injury. You ask for a

million dollars, he offers $500,000. Each of you bases his claim on a report by

his hired medical expert.

Judging by

past cases, you believe that the jury will split the difference and award you

$750,000. You are considering hiring a second expert witness. The probability that

he will agree on $1,000,000 is .9, but there is a risk (.1 probability) that he

will agree with the defense on $500,000.

With two experts testifying to damages of a million and one to $500,000,

you expect the jury to award $850,000. If it's two to one the other way, you

expect $650,000. The cost of hiring the expert witness would be $50,000.

Diagram the

question of whether to hire a second witness as a decision theory problem.

Should you hire him? Does it depend on whether your client is risk averse?

Explain.

(5

points)

With a risk neutral client you hire, since expected return

is:

DonÕt hire: $750,000

Hire: -$50,000 +.9(850,000) + .1 (650,000)=+780,000

A risk averse client will value the uncertain return from

hiring at less than its expected value. If the client is sufficiently risk

averse, he will prefer that you not hire.

[One student raised the possibility of hiring the second

witness and only having him testify if he agreed on $1,000,000. Not part of

what I intended, but a legitimate point.]

II. The

situation is as in problem I, with two changes. First, you have located a

reliable expert witness--one you are sure will agree with your figure on

damages. Second, you happen to know that the defense has located an expert

witness who is sure to agree with their figure, also for a price of $50,000.

With two witnesses on each side, the jury can be expected to award $750,000.

A. Analyze

the situation as a sequential game. First you decide whether to hire a second

witness, then the defense, observing your decision, decides whether to hire

theirs. Using the subgame perfect equilibrium approach, what should you do?

What is the outcome?

(5

points)

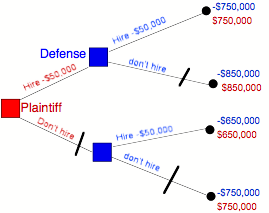

See diagram. Red boxes are choices by plaintiff, blue by

defense. Similarly for costs and final outcomes.

If Plaintiff hires, defense does better hiring (-$750,000)

than not hiring (-$850,000), so hires. Similarly if plaintiff does not hire. So

either way, defense will hire.

Plaintiff knows that, so hiring results in -$50,000+$750,000

= $700,000, not hiring results in +$650,000, so plaintiff hires.

B. Consider the situation as a simultaneous game. You

decide to hire or not hire an expert witness, so do they. Draw the game matrix.

What will the parties do? Explain. (5

points)

B. Consider the situation as a simultaneous game. You

decide to hire or not hire an expert witness, so do they. Draw the game matrix.

What will the parties do? Explain. (5

points)

|

Defendant |

Don't hire |

hire |

|

Plaintiff |

|

|

|

Don't hire |

(750,-750) |

(650,-700) |

|

Hire |

(800,-850) |

(700,-800) |

Hire dominates donÕt hire for both parties, so both hire.

C. What can

you say about the outcome in terms of the objectives of the two parties? Can

you think of any alternative approach that might lead to a more satisfactory

result for both? (5

points)

This is a prisonerÕs dilemma--both parties are worse off than

if neither hired an expert. Perhaps they could agree in advance to limit

themselves to one expert each.

III. Briefly

explain the advantages and disadvantages of including a liquidated damages term

in a contract instead of waiting until breach occurs and then letting a court

judge damages. Are there any advantages to a penalty clause—liquidated

damages substantially above the actual cost imposed by a breach? (5

points)

Advantage: Reduces litigation cost, since the parties wonÕt

have to litigate over the amount of the damage. Replaces the partiesÕ estimate

in advance with the judgeÕs estimate after the fact, and while the judge will

have more information, the parties may be better informed. Also, liquidated

damages eliminate the incentive for an inefficiently high level of reliance by

the party that might be the victim of breech.

Disadvantage: The estimate is being made in advance, so might

over or underestimate the actual damage when breech occurs, giving a party too

much or too little incentive to avoid breech.

A penalty clause amounts to a property rule adopted by the

parties--one party can breech only with the permission of the other, or by

paying a penalty. That makes sense if the parties believe that they can better

resolve situations that might lead to breech via negotiation than via the

courts.

IV. Firms

sometimes make expenditures in one year in order to generate revenue in the

next year or collect revenue in one year for services they will produce in the

next year. How does an accountant handle such situations? Why? (5 points)

An accountant tries to group expenditures and the revenues

they produce together. That can be done by classifying the revenues as accounts

receivable before they are actually received, to get them into the same year as

the expenditures, or by treating expenditures as prepayments–an asset

that balances the expenditure–in the year they are paid. The motive is to

make it easier to evaluate the decisions that led to both expenditure and

revenue.

V. Briefly

explain why we would expect the efficient market hypothesis to be approximately

true and why it cannot be precisely true. (5

points)

If it is easy to see that a stock is underpriced, people will

buy it, driving its price up to its value, so the price of a stock will tend to

be equal to its actual value--the expected value of the present value of all

income streams that come from owning it.

But if all stock prices are exactly correct there would be no

benefit to doing the research to identify underpriced (or overpriced) stocks,

so nobody would try, so the mechanism about wouldnÕt work.

VI. The

risk free rate of return, what an investor can get on an investment with a

known and certain payoff, is 4%. The rate of return on a random collection of

stocks is 6%. Why are they different?

Because the random collection of stocks has an uncertain

return and investors are risk averse--sufficiently risk averse to be

indifferent between 4% for sure and 6% with whatever the uncertainty of a

random collection is.

Your

company's performance anti-correlates with the market--when most stocks go up,

yours goes down, and vice versa. What can you say about the return you will

have to offer investors in order to get them to invest in your firm? Explain. (5

points)

You will be able to get investments at less than 4%, because

an investor who adds your stock to a random bundle actually reduces his risk,

making it better than a risk free investment.

VII.

Briefly explain what economists mean by efficiency. (5

points)

Efficiency is a measure of the Òsize of the pie,Ó the degree

to which people get what they want. Outcome A is more efficient than outcome B

if the change from B to A provides net benefits, defined by how much each

person affected would pay to get the change (+) or prevent it (-).

VIII.

Briefly explain Pigou's view of externalities and what to do about them and

Coase's critique of it. Use the back of the page. (10

points)

Pigou viewed an externality as a cost one party imposed on

another. His solution was to charge the cost to the former party, thus forcing

him to take account of it in deciding what actions to take.

Coase pointed out that the cost is typically the result of

choices by both parties. Imposing it on one leads to an inefficient outcome if

the other can solve the problem at lower cost--using land under the flight path

for something not sensitive to noise instead of requiring planes to reduce the

noise they produce, for instance. He also pointed out that, as long as

transaction costs are low, the parties have an incentive to eliminate the

inefficiency by agreement. If I am imposing a $100 cost on you at a $50 benefit

to me, I should be willing to accept some payment between the two numbers to

agree to stop doing so.

IX. How do

economists define negligence? Briefly explain how a negligence rule can give

both tortfeasor and victim the correct incentive to take precautions. What

happens if some precautions cannot be observed by the court? (10

points)

Negligence is defined by economists as failure to take all

cost justified precautions. Under a negligence rule the potential tortfeasor

finds it in his interest to take all cost justified precautions, since if he

doesnÕt he will be liable for all costs and if liable for all costs it is in

his interest to take all cost justified precautions. Since he chooses not to be

negligent he wonÕt be liable, so the victim wonÕt be compensated, so it will be

in the victimÕs interest to take all cost justified precaution.

If some precautions cannot be observed by the court, the

potential tortfeasor will find it in his interest to take the efficient level

of the observable precautions, freeing him from liability, and then to base his

level of unobservable precautions only on costs to him.

X. What is

the argument in favor of a legal rule of caveat emptor (let the buyer beware)? Caveat venditor? In what sort of situation is each desirable? (5

points)

Caveat emptor gives the

buyer an incentive to take precautions to reduce risk and amount of

damage--wear shoes when using a power mower, for instance. It also reduces

litigation costs, since the damage normally falls on the buyer when a product

fails, so no need for liltigation to shift the cost.

Caveat venditor gives

the seller an incentive to take precautions to reduce risk and amount of damage

from product failure. This is unnecessary if the buyer can easily discover the

risks, since then the seller already has the needed incentive. But it is useful

if buyers can be expected not to know the risk.

So Caveat emptor makes

sense where the important precautions to be taken are by the buyer or where the

buyer can easily judge risks of products he buys. Caveat venditor makes sense if neither is true and there are important

precautions to be taken by the seller.

XI. Briefly

explain the argument for setting expected punishment for a crime equal to

damage done. Might it be efficient to have expected punishment greater than

damage done for some sorts of offenses, less than damage done for others?

Explain. (5

points)

Expected

punishment equal to damage done forces the criminal to internalize the

externality, so he will only commit the crime if his benefit is more than the

victims loss, in which case the offense is efficient and we donÕt want to

prevent it. This is the right rule if we ignore the cost of catching,

convicting and punishing criminals.

If

catching and punishing criminals is costly, the efficient level of punishment

is sometimes higher, sometimes lower. It may be higher to deter some mildly

efficient offenses so as to save the cost of catching, convicting and punishing

the offenders. It may be lower to permit those offenses which produce a net

loss smaller than the additional cost of making expected punishment high enough

to deter them.

The

former situation is associated with a more elastic supply of offenses;

increasing punishment a little decreases the number of offenses a lot, and

spending more per offense on fewer offenses then ends up with lower total

expenditure. The latter situation is the other way around.

XII. A friend claims that boys

are relatively better at mathematical skills, girls at verbal skills. To test

his claim, you obtain a random sample of 900 scores from boys who took the SAT

last year. On average, their math

score is ten points higher than their verbal score, which appears to support

your friend's claim.

The test is

designed so that the difference between the math and verbal scores, averaged

over all test takers, is zero. You reason that if boys are not, on random,

relatively better at math, the mean difference for them should be zero too.

From your

sample, you estimate that for the population the standard deviation of the

difference of the scores is thirty. What is the standard deviation of the mean

of a sample of 900?

1

What is the

Z statistic for your result?

10

Do you

think it is significant at the .05 level? Yes .01 level? Yes

You may if

you wish use the attached table.

No need. Z=10 is huge.

Should you

use a single or double tailed test and why? (10

points)

Single tailed. His claim is that boys are better at math

skills, not that they are better at one or the other. So a result in the other

direction, negative Z, would be evidence against his claim, not evidence for

it.

XIII. Your

client, Megacorp Inc., employs more than 90,000 people of a bewildering variety

of ethnic origins. You have been sued by an enterprising law firm,

ClassActionsRUs, acting on behalf of J. Lilovich et. al., for discriminating

against Americans of Bosnian descent. Their evidence is a statistical study

showing that the wages of your Bosnian employees are lower than the average

wage of your employees by $430/year, a result which, their study shows, has

less than a .05 probability of occurring by chance. Since, they explain, the

odds that Megacorp is discriminating are better than twenty to one, they have

obviously satisfied the civil standard of proof.

List at

least three different and independent reasons why their argument is wrong. Pick

one of them and briefly describe how you would explain it to a jury. (10

points)

1. With lots of ethnicities, the odds that at least one of

them will, by chance, receive an average salary that low are high; the law firm

obviously checked all of them and only reported on the one for which the salary

was noticeably below average.

2. Since they didnÕt do a multiple regression, it is entirely

possible that the reason is differences in characteristics of the employees.

Perhaps, for instance, the Bosnians are on average more recent hires than other

employees, or less educated, or É

.

3. Aside from those problems, the odds coming out of the

study represent the probability that the average wage of an ethnicity would be

that far below the average by chance, assuming no discrimination, not the odds

of discrimination, given that the average wage came out that far below the

average.

Not being a lawyer, IÕll leave it to you to figure out how to

present one of these to the jury.

XIV. A

large statistical study of the results that high school students get on the SAT

exam finds:

A negative

correlation between age at which the test was taken and score.

A strong

positive correlation–.8–between number of books read per year and

score on the verbal part of the exam.

If you want

your child to get a good score on the exam and get into a good college, should

you require him to read a book a week and insist that he take the exam a year

early? Discuss. (5

points)

Probably not. Students who take the test early are likely to

do so because they are smart--either have skipped grades or concluded that they

can do well in an earlier grade than the test is usually taken. The causation

is probably running from intelligence to early test taking, not the other way

around.

Similarly, liking to read is both a cause and effect of high

verbal skills. We donÕt know whether making someone who doesnÕt like to read

read a book a year will raise his verbal skills or not.

XV. A

multiple regression on the results of the study described in the previous

question uses total SAT score (math + verbal) as the dependent variable, age,

IQ, parental income, parental education, average teacher salaries in the school

the student went to, average class size in the school the student went to,

number of books in the student's home, as independent variables. Despite the

correlations reported in the previous question, it turns out that none of those

variables is significant at the .05 level. Does this imply that none of them

significantly affects SAT outcomes? Explain. What further analysis of the data

might you use to see what is actually happening? (10

points)

The problem is that the independent variables are highly

correlated with each other, so no one of them much improves the fit given that

the others are already there. You should check correlations between variables,

remove one of any pair that are closely correlated (or two of any triple or É),

and redo the regression.