Midterm Exam

(You may leave any complete question

or questions blank for 20%)

1. Your employer, the Prudent Bank and Trust Co., is being sued by

GetRichQuick.com, an online investment company that bought a

substantial quantity of mortgage based securities from PBT and lost

quite a lot of money on them.

After a preliminary investigation you conclude that without substantial

evidence of misrepresentation they have zero chance of prevailing.

Unfortunately, several of your employees engaged in extensive email

correspondence with GRQ employees prior to the transactions, and there

is some risk, you think about 20%, that somewhere in that email there

is something that could be interpreted by a court as misrepresentation,

raising their chance of prevailing to 10%. If they do prevail you

expect them to be awarded $10,000,000. Hiring someone to do a careful

search through the accumulated email will cost $50,000. GRQ has offered

to accept $250,000 to settle their claims and you believe this is

their final offer. You estimate your trial costs if the case is not

settled at $100,000.

Draw a decision theory diagram for the problem on the back of page 3

and use it to decide what to do with regard to deciding both whether to

search and whether to accept the settlement offer or go to trial.

Explain if necessary. (10 points)

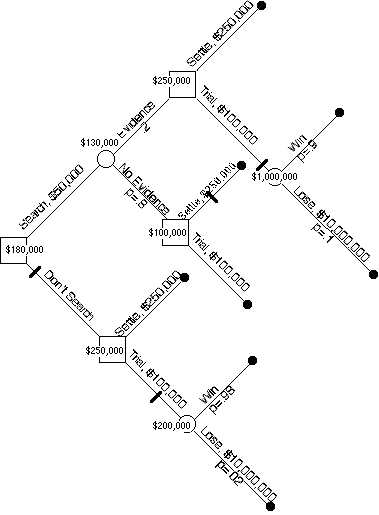

The first choice is whether to

search or not.

If you don't search, the next

choice is to settle ($250,000 cost) or go to trial ($100,000). If you

go to trial there is a .02 chance of losing (.2 chance there is

evidence x .1 chance if there is evidence that you will lose--I could

have shown this as two separate die rolls but didn't bother) and a .98

chance of winning. Winning costs you nothing, losing costs $10,000,000,

so .02 chance of losing costs $200,000. That plus the $100,000 trial

cost is more than the cost of settling, so if you don't search you

settle, making the cost of that branch $250,000

If you do search, you find

evidence (p=.2) or don't (p=.8). If you do you can settle for $250,000

or go to trial. Trial costs $100,000, a .1 chance of losing costs

$1,000,000, so total cost is $1,100,000, so if there is evidence you

settle. If you don't find evidence trial costs you only the $100,000

trial cost, since you are sure to win, and that's lower than the

$250,000 settlement cost. So if you don't find evidence you go to trial.

So you have a .2 chance of finding

evidence, cost $250,000, a .8 chance of not finding it, cost $100,000,

total expected cost $130,000. Add to that the $50,000 search cost and

the expected cost if you look for the evidence is $180,000, which is

less than the expected cost if you don't. So you look for evidence,

settle if you find it, go to trial if you don't.

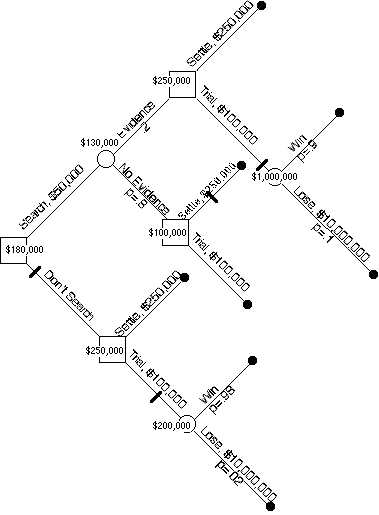

2. Consider the previous problem from the standpoint of Lenny

Litigator, GRQ’s attorney, who agrees with you about the facts of the

situation. Lenny is deciding what his settlement demand should be; his

costs if the case goes to trial are $50,000.

A. Use game theory—specifically, subgame perfect equilibrium—to decide

whether he (and his client) are better off demanding $250,000 or

$100,000. Assume all parties are risk neutral. Draw any necessary

diagrams on the back of page 2.

We have already analyzed what

happens if he demands $250,000. The defendants pays for a search,

settles if there is evidence (p=.2), goes to trial if there isn't

(p=.8). From Lenny's standpoint that means a .2 chance of $250,000 in

settlement, a .8 chance of paying $50,000 for a trial and getting

nothing, for an expected return of $50,000-$40,000 = $10,000

If he demands $100,000, settling

is cheaper than search+either settling or paying for a trial, so the

defendant will settle, giving Lenny $100,000.

So better to demand $100,000.

B. Can you think of any reason why the assumptions of subgame perfect

equilibrium might not hold in this situation? (10

points)

The defendant might want to go to

trial even with the lower demand, in order to lower the plaintiff's

return and so discourage future plaintiffs.

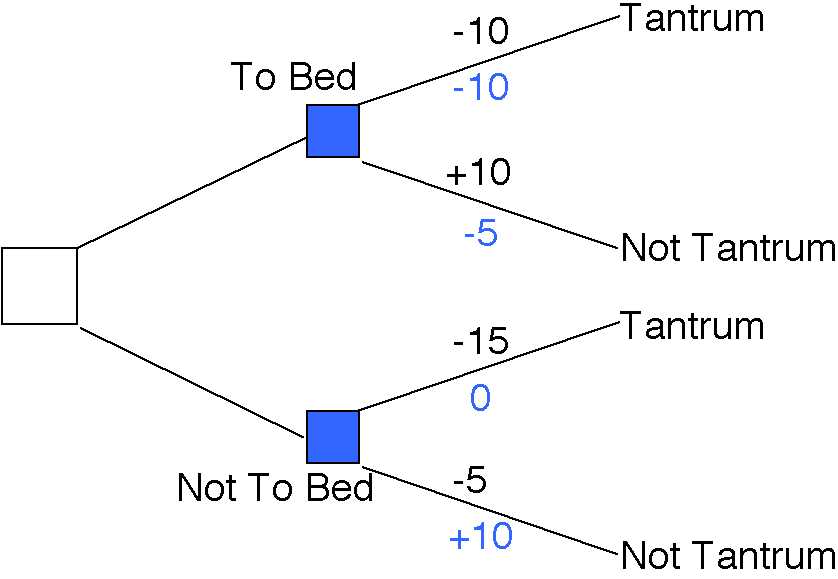

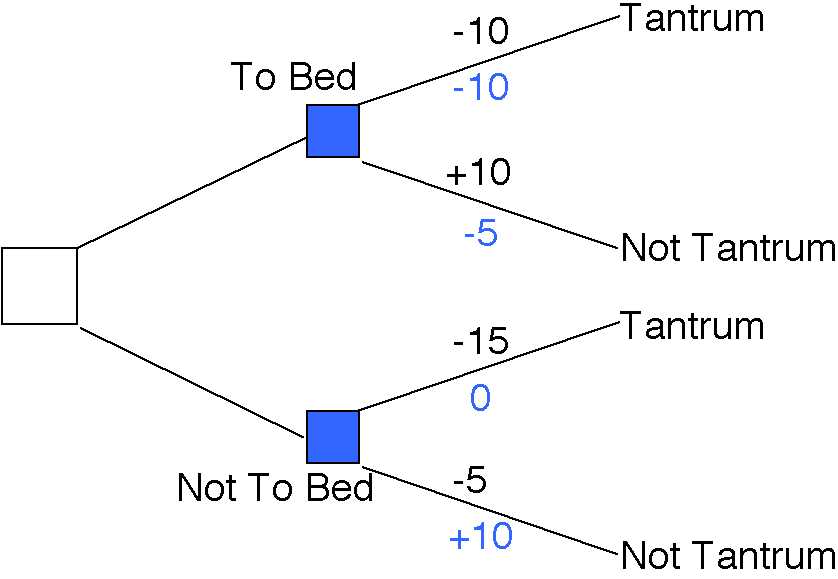

3. The diagram shows the "put to bed/tantrum" game discussed in class;

the parent's payoffs are black, the child's blue. The same game can

also be described using a strategy matrix, shown below. Define the

strategies and fill in the cells with the payoffs to each player.

ParentStrat1: Put to bed

ParentStrat2: Don't put to bed

(let stay up)

ChildStrat1: Never throw a

tantrum, whether or not put to bed

ChildStrat2: Always throw a

tantrum, whether or not put to bed

ChildStrat3: Throw a tantrum only

if put to bed

ChildStrat4: Throw a tantrum only

if not put to bed

(5 points)

|

Child's Strategies

|

ChildStrat1

|

ChildStrat2

|

ChildStrat3

|

ChildStrat4

|

Parent's

Strategies

|

ParentStrat1

|

(10,-5)

|

(-10,-10)

|

(-10,-10)

|

(10,-5)

|

ParentStrat2

|

(-5,10)

|

(-15,0)

|

(-5,10)

|

(-15,0)

|

4. The Law School has decided to offer every graduating student a

free

Bar prep course in the hope of raising its Bar passage rate. It is

negotiating with PaBar, a small but well respected firm that produces

such courses. The central issue being considered is how to determine

how much PaBar is paid. Should it be based on the number of students

who choose to take the course, the number of student hours spent in

class, the number of students who, after taking the course, pass the

Bar Exam on their first try, or the percentage of graduating students

(including those who do not take the course) who pass the Exam on their

first try?

A second issue is where the courses are to be given. Should PaBar find

its own facilities, and if so who should pay for them? Alternatively,

should PaBar be offered the use of university classrooms, if available,

and on what terms?

Briefly describe several possible contracts, the problems each might

raise and how they should be dealt with, and recommend the one you

think best. You may use the back of page 1. (15

points)

Compensation: With cost plus,

PaBar's only incentive to keep costs down is the hope of future

business. Since it is presumably running some other courses, there

might be problems measuring cost--PaBar would have an incentive to try

to allocate as many costs as possible to its university

courses--overpay teachers there with the understanding that they would

work for lower wages in its other courses, for instance.

Fixed payment has two problems.

One is that Paybar, as a small firm, may not want to bear the risk of

higher costs. But the only element that one would expect to be

unpredictable is the number of students, and the fixed payment could be

made on a per student basis.

The other problem is the incentive

to lower quality in order to save money. Which brings us to …

Giving Pabar an incentive to do a

good job. The simplest way would be to make the compensation in part

depend on how many students pass the bar--not entirely because PaBar is

probably risk averse. This raises some further problems, however.

If the bonus is per student who

passes, PaBar has an incentive to try to encourage students likely to

pass to enroll and to discourage students unlikely to pass--still more

so if it's based on the percentage of students who taking the PaBar

course who pass the bar. What the school wants is to maximize the

fraction (or equivalently the total number) of its graduating students

who pass. So it could base the bonus on that number, counting both

students who have and students who have not enrolled in PaBar. That way

Pabar has no incentive to try to cherry pick the students who would

pass anyway. Instead it will invest its efforts in whatever gives the

greatest increase in bar passage rate per dollar spent.

So far as facilities, the school,

having agreed on a fixed rate per student plus bonus compensation plan,

should offer its facilities to PaBar at cost, and leave it free to rent

outside facilities if that costs less.

Contract 1: Cost plus a bonus for

each student who enrolls in PaBar. No incentive to keep cost down, and

an incentive to try to attract students whether or not the added course

will increase their chance of passage.

Contract 2: Per student payment,

bonus based on percent of students taking the course who pass.

Incentive to cherry pick the students who would probably pass anyway.

Contract 3. Per student payment,

bonus based on total number of graduating students who pass (meaning in

each case pass at the first try), including those who didn't enroll.

Best alternative of the three for reasons sketched above.

A further point one student made

was that if the contract does not provide an adequate incentive to

maintain quality, the law school might want to monitor the teaching in

an attempt to measure quality--although it's not clear what the school

can do if it isn't satisfied.

[This question didn't have a single right answer--what I wanted to see

was how well you could analyze the problem.]

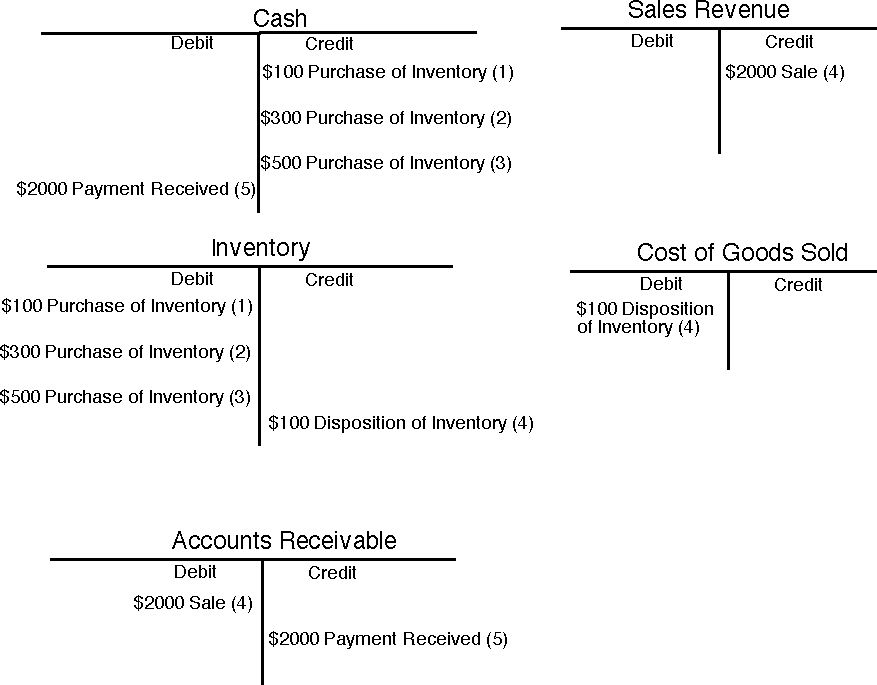

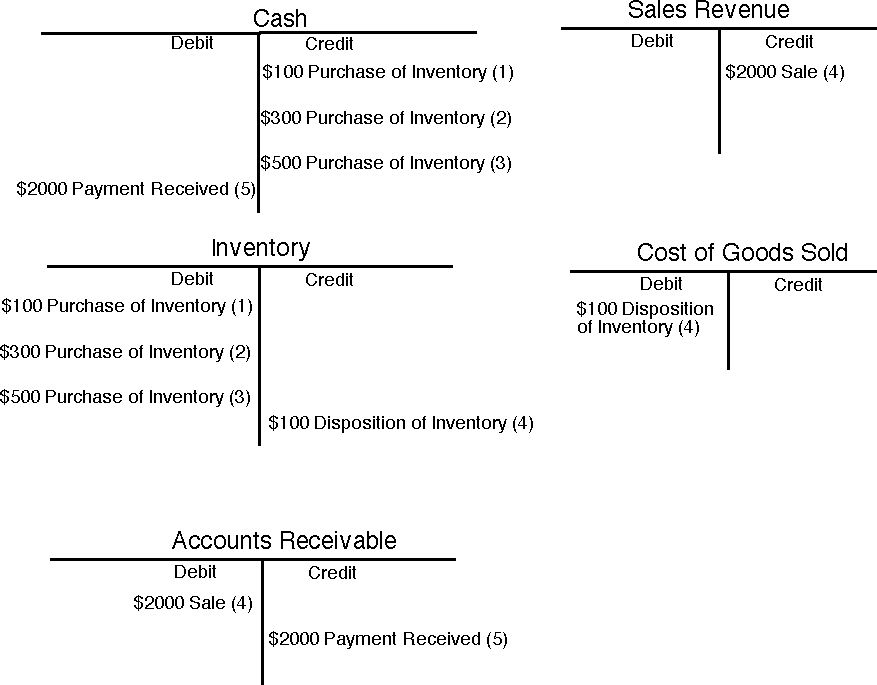

5. High-Brow Decorators sells furnishings for fancy offices,

specializing in an old English library look.. One of its most popular

furnishings is a "wall" of 1000 old books. In its inventory, the

company has three "walls" of old books. The first it purchased for

$100; the next it purchased for $300 and the third it purchased for

$500. The price of old books varies based on the scrap value of used

books at the time of purchase. One of High-Brow's customers – Joan

Lawyer – who just became a partner in a fancy law firm orders one wall

of books for $2000; the firm delivers the books and bills Joan.

Show the T-accounts for the three purchases and the sale. What is the

combined result of the series of transactions on the firm’s total

assets, liability and equity?

Assets go up by $1900 (FIFO) or

$1500 (FIFO). Liability unaffected. Equity up by the same amount as

assets.

Draw a final set of T-accounts to show what happens when Joan pays

the

bill. How does that affect the firm’s total assets, liabilities and

equity?

(5) in the T-accounts above.

Assets, liabilities and equity are unchanged--one asset (account

receivable) has been converted into another (cash).

State any assumptions you are making about the firm’s accounting

practices. (10 points)

The T Accounts assume FIFO--with

LIFO item 4 would be $500.